I am a

little late. Sorry, for being late with the report. Good Morning, Good

Afternoon or Good Evening where ever you are in the world. This is Texas Trade

Report for 26 December 2013. I am Liz S, your currency analyst for this

daily edition.

I will be talking about the CAD/JPY, AUD/CAD, GBP/CAD

currency pairs, gold and oil in this daily report. This is sole focus of this

report. Before I can go any further, here is the risk disclaimer.

Risk Disclaimer:

Trading Forex is a risky business and sometimes you will lose the money that you traded. You are leveraged 50:1 or even more. There is the risk of loss of the money have invested. Never invest money that you are not committed losing. There is a possibility of losing your original investment. If you are not sure about investing, seek the help of registered investment adviser.

Also, the purpose of this trading lesson is education. This does not constitute trading advice. Nor do I give out trading signals. All opinions are my own and not Blogger.com nor Google.com.

|

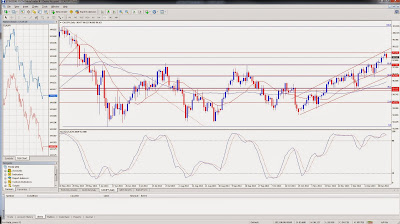

| CAD/JPY Daily Chart |

Onto the CAD/JPY,

this pair had made it as a high to 98.59 the daily chart. It is currently

trading at 98.07. This pair has been trending upward for some time. With

conditions still not normal, we will continue to see weird trading conditions.

The Bank of Japan stated that they are opting to continue their stimulus plan

and bond buying purchases. This is why you see this upward trending scenario in

place including the price of . Now, I don’t think that this will continue

forever. Because it has been one way trade in one particular direction since

November 4. The price of oil will probably send this pair up. I do expect that

we do see this pair going to 101.06 level at some point down the road. Here are

the fib levels on the daily chart. The

fib levels at 23.6% level are 94.01 and 95.32 at 38.2 fib level. At 50.0 % fib

level is 96.49. At 61.8 fib level is 97.46.I am bullish for now.

Onto the AUD/CAD,

this pair had made it as a high to 0.9518 the daily chart. It is currently

trading at 0.9509. This pair has been trending down since October 25 2013.

At some

point, I do believe that this will start to bottom out. We just do not see

right at the moment as to when it will. I do expect in the coming days and

weeks that it will. This pair has been acting much like its counterpart the

AUD/USD. I am still expecting it will trend up. The fib levels at 23.6% level

are 0.9408 and 0.9556 at 38.2 fib level. At 50.0 % fib level is 0.9676. At 61.8

fib level is 0.9798. I am neutral right now until we do form bottom.

Onto the GBP/CAD,

this pair has been trending up and is still in a rising wedge pattern. It is currently

trading at 1.7647. It made a high of 1.7669. This pair is rising to the upside.

The key fib level for 23.6% are 1.5970 and at

38.2% fib level is 1.6301. At the 50.0% fib level, it is 1.6563 and at the

61.8% fib level 1.6830. Quiet market conditions are prevalent today. I am going

to wait for confirmation. It has risen too fast. We do see this with a lot of

the Yen crosses. I am neutral until we can get confirmation for bearishness.

20131227.png) |

| Gold Daily Chart |

Onto

gold, we did get a small pullback and a minor one.. It is currently trading at $1212.90.

I still believe that break above the $1265.95 and stay above it that would be

bullish. We don’t have any major

activity at the moment. I am still bullish longer term for gold when it does

form a solid bottom. I am going to wait and see if what happens at this point.

Onto oil,

it is currently trading at $100.41 a barrel and is up a little bit. It is up by

0.86%. We forecasted that oil would go above $100.00. The key fib levels for

oil at 50.0% at $100.50 and 102.79 at 61.8 fib level on the daily chart. It is

happening at the time of writing this article. I am still bullish on oil.

The markets are still bullish and will finish out that way. I am not expecting risk aversion to take hold at the end of the year. I do expect going into the new year that we might see some risk aversion. The new year will be a bit different. We have overbought markets and there is ample indication of it. We still have abnormal trading conditions. I do expect the markets will return to the normal conditions that we see with overbought and oversold to return to normal and not to extremes like we have the holidays. Also,here

is a little quick reminder. Also, I will donating some of the commissions as an

affiliate from the products and service anyone buys from this website to the

locating charities especially after volunteering two days ago. This means if you

buy gold and silver from Regal Assets, I will donate 10% of my sales

commissions as an affiliate spokesperson. I will put out another report on

Sunday. Have great weekend and good luck trading for the rest of today. m Regal

Assets and them to people in need and

giving the local food banks.

If

you like the information that has been presented, bookmark this page and the

Texas Trade Report Blog in your favorites and send link to it to everyone you

know. Blog about it on Facebook, Twitter it to friends and family. That is

the way it unfolds.

No comments:

Post a Comment